Intro

Tax season can feel like a puzzle. You’ve got forms, deadlines, and that nagging fear of missing deductions. TurboTax simplifies this—but picking the right version matters. Let’s break down TurboTax Home & Business 2022 and Deluxe 2021/2023 so you can file confidently, save money, and avoid IRS headaches in 2025 too.

Who Needs TurboTax Home & Business?

For freelancers, gig workers, and small biz owners.

—————-Recommendations, Please continue reading below—————-

Highly rated daily-life products at low prices Shop Now

From bedding to office furniture and supplies, from kitchen accessories to health & fitness, from storage to travel bags, the amazon basics provides hundreds of daily use products at amazingly low prices with having highly rated consumers feedback. Click here to learn more >>>

- Handles Schedule C: Reports business income/expenses (e.g., Uber drivers, Etsy sellers).

- W-2/1099 Creation: Generates contractor or employee tax forms.

- QuickBooks Sync: Pulls data automatically—no manual entry.

- Audit Defense: Includes 1:1 support if the IRS questions your return.

Cost: 130 (download) for federal + 1 state. Extra states: 45 each.

Pros:

- Finds industry-specific deductions (e.g., home office, mileage).

- Imports prior-year data to save time.

Cons:

- Pricier than Deluxe.

- Can’t file S-corp/partnership returns—requires TurboTax Business.

TurboTax Deluxe: Best for Homeowners & Investors

For itemized deductions (charity donations) or stock/crypto sales.

- 2021 vs. 2023: Deluxe 2023 adds better crypto reporting and updated tax laws.

- Mobile App: Snap a photo of your W-2 to auto-fill forms.

- Audit Risk Check: Flags IRS red flags before filing.

Cost:

- Deluxe 2021: ~$80 (download).

- Deluxe 2023: 59–89 (online) + $59 per state.

Pros:

- Cheaper for non-business filers.

- Easy to amend returns if you make a mistake.

Cons:

- No Schedule C support—upgrade to Home & Business if you earn freelance income.

- Hidden fees: State e-filing costs extra (20–25).

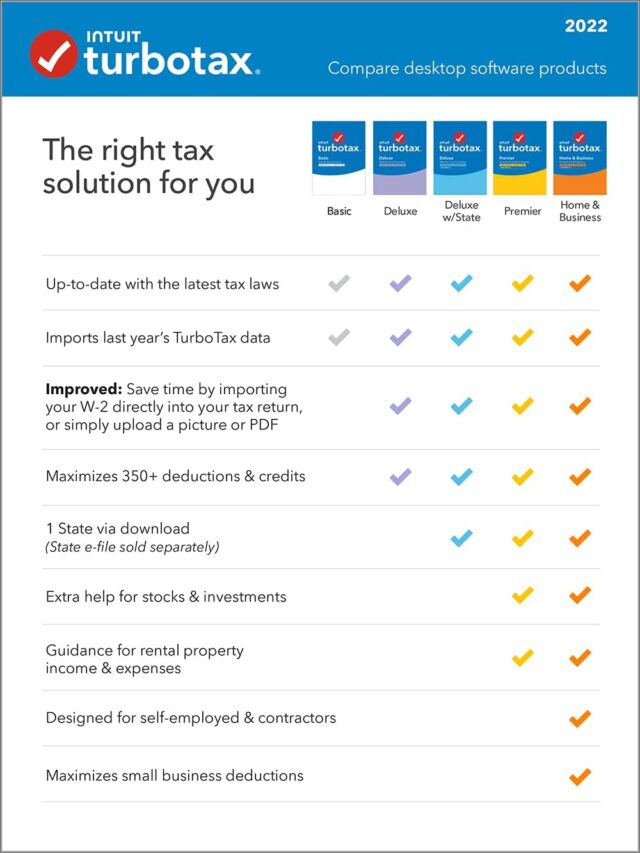

Key Differences at a Glance

| Feature | Home & Business 2022 | Deluxe 2021/2023 |

|---|---|---|

| Business Income | ✅ Full support | ❌ No |

| Deductions | Industry-specific + personal | Itemized (home, medical) |

| Audit Help | Full defense + expert calls | Basic guidance |

| Best For | Freelancers, small biz | Homeowners, casual investors |

FAQs: What Real Users Ask

- “Can I file personal and business taxes together?”

Yes—with Home & Business. But if you have an S-corp, you’ll need TurboTax Business and a personal edition. - “Is the online version different from the desktop?”

Yes. Home & Business is a desktop download (unlimited returns), while Self-Employed is online (1 return per account). - “Can Deluxe handle self-employment income?”

Only income—not expenses. Use Home & Business or Self-Employed for deductions. - “Why does TurboTax cost more each year?”

Prices rise due to added features (e.g., crypto support) and inflation. Look for discounts on Amazon. - “Is TurboTax Free Edition worth it?”

Only for very simple returns (W-2 income, standard deduction). H&R Block’s free version covers more situations.

TurboTax Hacks to Save Time & Money

- Skip Upsells: TurboTax pushes add-ons like Audit Defense ($50). Skip unless you’re high-risk.

- File Early: Prices jump closer to April 15. Buy in January for lower rates.

- Use Mobile App: Track deductions year-round—snap receipts instantly.

- Check State Fees: Some states charge $45+ to e-file. Print and mail for free.

Why Trust TurboTax?

- Accuracy Guarantee: They cover IRS penalties for calculation errors.

- Live Support: Paid tiers include 24/7 help from CPAs.

- 5-Day Early Refund: Get your refund faster for a small fee.

The Downside: What Users Hate

- Confusing Names: “Home & Business” vs. “Business” trips up new filers.

- Bundled Software: Forced McAfee/Quicken installs annoy users.

- Price Hikes: Deluxe 2023 costs 20% more than 2021.

2025 Trends to Watch

- AI Tax Help: TurboTax Live expands with AI chatbots for instant Q & A.

- Crypto Reporting: Deluxe 2023 improves tracking for Bitcoin/ETH sales.

- IRS Free File: After lawsuits, TurboTax now directs eligible users to free options.

Final Verdict

Choose Home & Business if: You’re self-employed or own a small biz. The Schedule C support pays for itself.

Choose Deluxe 2023 if: You own a home, invest, or sold crypto. The updated tools are worth the cost.

Pro Tip: TurboTax often offers discounts for military, students, or early filers—check their website before buying.

Ready to File?

Grab your W-2s, fire up TurboTax, and tackle taxes with confidence. For step-by-step guides, visit TurboTax’s official site or check out Money Done Right’s 2025 tax hacks. Time to turn that refund into a reality!

Now loading...